Bank to bank Real-Time Payments

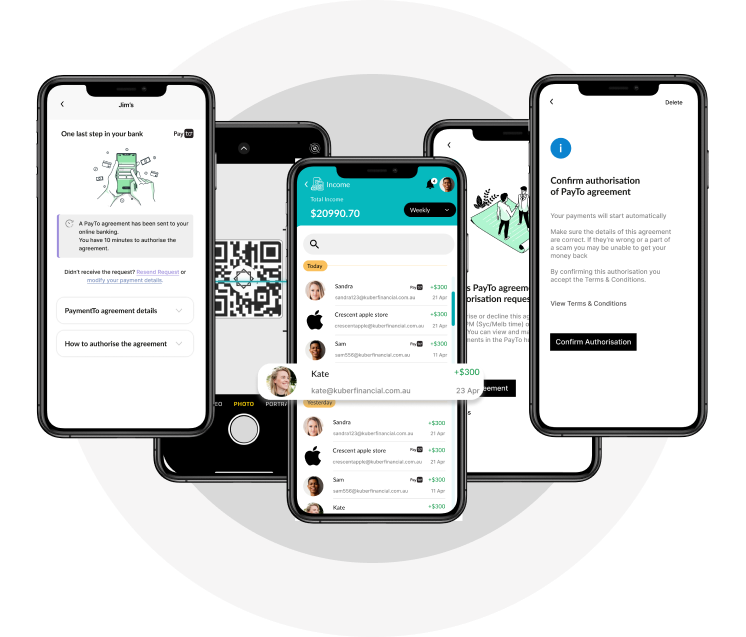

with Kuber  QR Code

QR Code

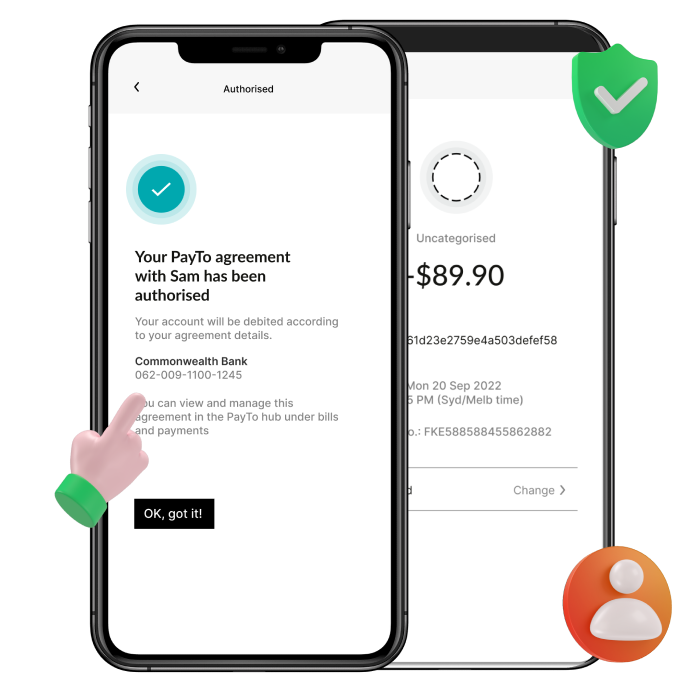

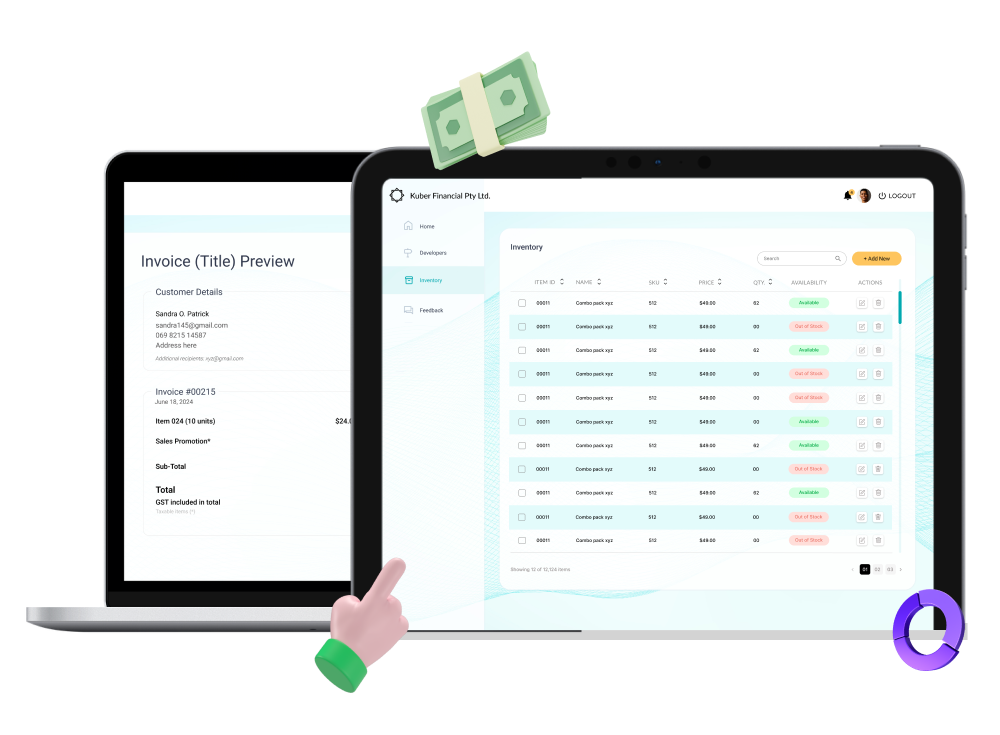

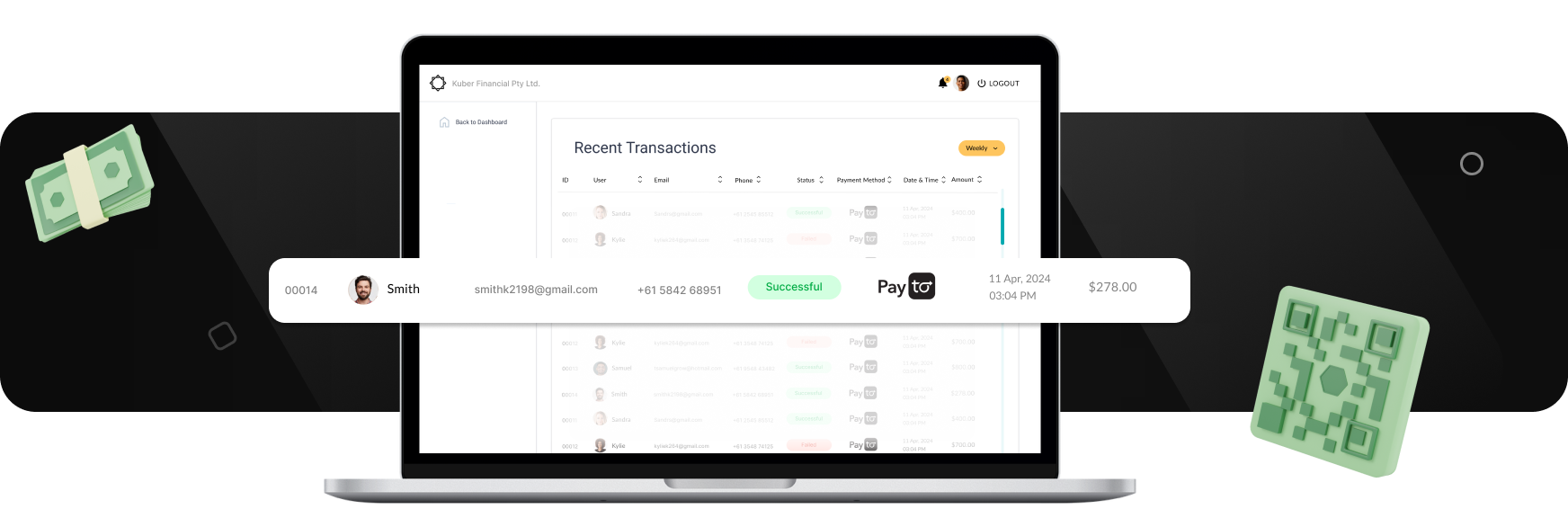

With PayTo, businesses can accelerate cashflow and receive funds instantly, by intitiating one-time, ad-hoc or recurring payments directly from their customers' bank accounts.